A well-known fact for doing business anywhere in the world is that fulfilling tax obligations is absolutely mandatory, and is one of the most important elements to keep track of. Errors in tax filing and submitting can have severe financial and legal consequences. Vietnam, in particular, has a considerably complex tax structure, which might be hard to navigate without the right expertise. All corporate entities in Vietnam are required to comply with the local accounting & tax regulations, no matter their size, field, or operating scope.

Therefore, it is essential to understand how taxes can affect your company and business and what kind of taxes you and your company must pay to the Vietnamese government while running a business and earning revenue in the country.

Having trouble with tax compliance setup or accounting processes? Outsourcing is the go-to solution for expanding businesses in Vietnam. Find out how you can stop worrying about tax obligations altogether.

For enterprises, the most common types of taxes in Vietnam that you must familiarize yourself with include:

- Corporate income tax (CIT), which is levied on the company itself

- Value added tax (VAT), which is levied on goods and services

- Personal income tax (PIT), which is levied on the company’s members and employees

In this guide, we will demonstrate and elaborate on Vietnam’s corporate tax structure and discuss tax rates and tax obligations, to give you a clear, accurate picture of what to expect when doing business in Vietnam.

What is the tax structure in Vietnam?

As we were saying, the Law on Enterprise imposes tax obligations on all business enterprises incorporated in Vietnam. These duties include a variety of accounting functions: paying taxes, filing and submitting financial statements, conducting audits, and much more.

For companies that are partially or even 100% foreign-owned, once it is incorporated, it will be treated as a Vietnamese tax resident. Therefore, the company has to fulfill its obligations as a resident taxpayer.

Failure to comply with tax regulations can result in the suspension of your business or even worse, dissolution and liquidation.

Corporate income tax

In Vietnam, corporate income tax is normally levied at a flat rate of 20%. This rate is in line with other Southeast Asian countries and relatively low compared to China or India. Moreover, businesses belonging to certain industries and/or operating in specific locations receive tax deductions. These incentives are determined based on your business’s geography, industry, and the exact conditions of projects you undertake.

There are cases where CIT is higher than the standard rate, however. CIT on exploration and extraction of petroleum in Vietnam is from 32% to 50%. For rare and valuable resources such as precious metals and minerals, it goes up to 50%. If at least 70% of the allocated area is located in geographical regions with difficult socio-economic conditions, the rate may be reduced to 40%. It’s important to research all taxes applicable to your business sector and location before you start.

RELATED: Steps to Setup and Manage Your Corporate Income Tax (CIT) in Vietnam

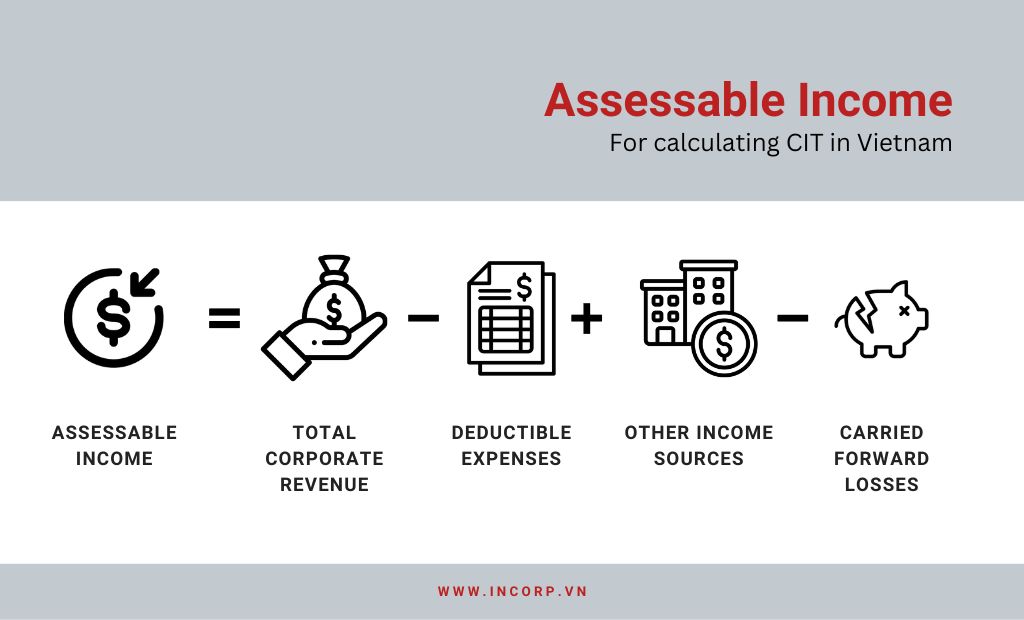

Here’s how you can calculate your CIT based on your assessable income and the current CIT rate that applies to your business.

ASSESSABLE INCOME × CIT RATE = CIT Payable in the period

In which, assessable income will be:

With the government’s commitments to improving and expanding the national economy, several tax incentives have been introduced to help businesses. Businesses are able to take advantage of preferential tax rates for a number of encouraged sectors:

- Healthcare

- High-tech companies

- Software development

- Education

- Infrastructure development

- Environmental protection

- Aquatic and agricultural products processing

- Scientific research

- Renewable energy

There is no guarantee of a deduction as these priorities change yearly.

Value added tax

Value added tax (VAT) is a type of indirect sales tax on products and services. This means that businesses serve as VAT intermediaries to collect this tax from customers, and in turn, pay it to the government.

The VAT rate is determined by your business sector and the category of goods and/or services that your business offers.

VAT also applies to products and services imported from outside the country. Therefore, if your company trades and imports products and/or services in Vietnam, you must register for VAT declaration as soon as you have your business permits.

For the majority of product types, a 10% flat VAT rate applies. The VAT rate on goods and services under the state’s priority and incentive policies is 5%. There is also a 0% VAT rate available for exported goods and services and their delivery.

Update for 2022: Resolution 43/2022/QH15 issued by the National Assembly of Vietnam reduces the VAT rate of qualifying goods and services from 10% to 8%, valid until the end of 2022. The goal of this policy is to boost post-pandemic economic recovery and development.

There are, however, three groups of taxable items, which can be found in Decree 15/2022/ND-CP, will not receive the tax cut. These items fall under several categories including information technology and financial services.

For Vietnam, there is a distinction between items that are exempt from VAT and items that enjoy 0% VAT, according to Circular 219/2013/TT-BTC. As mentioned, exports and the delivery of exports belong to the latter, and businesses in the field still have to register and declare their VAT.

VAT exemptions mean that the business is free from all VAT obligations. Exemptions are granted to 26 categories (see the Circular’s appendices) of goods and services to encourage agricultural production; subsidize materials that cannot be manufactured domestically; and services that are essential to citizens’ lives and not of commercial nature.

Here is a comprehensive list of the VAT rates you should be aware of:

- 0%: International transport, offshore construction, exported products and services, agricultural machinery, animal feed, fertilizer;

- 5%: Basic food and drinks, necessities, public transportation, agricultural products and services, medical devices;

- 10%: Other taxable products and services;

- 15%: Luxury goods.

Enterprises in Vietnam can declare VAT in two ways: the direct method, which only applies to some household businesses or micro-enterprises based on their revenue, and the indirect method. The indirect method is the default method for most businesses and is calculated using the gap between their output VAT and input VAT.

The procedure for declaring VAT is relatively straightforward. It involves using the HTKK (Declaration Support) software issued by the government to export your tax information (some manual adjustments might be needed) and submitting it to the Ministry of Finance.

VAT refunds in Vietnam apply to the cases below

- VAT refund for exported goods and services

- VAT refund for investment projects

VAT refunds are an essential element of a business’s cash flow and growth. Your business can qualify for a VAT refund if you meet these requirements:

- The business pays VAT via the credit method;

- The business has a valid enterprise registration certificate, an investment license (practice license), or an establishment decision, issued by a relevant authority;

- The business has a registered stamp compliant with the law;

- The business prepares and keeps accounting books and documents as required by the Law on Accounting;

- The business has a deposit bank account registered with its tax code.

When can the enterprises submit the dossier for a VAT refund application?

If the VAT input is not completely subtracted after 12 months or four consecutive quarters and the deductible VAT amount carried forward exceeds VND 300 million, the enterprise is entitled to a refund.

Personal income tax (PIT)

Personal income tax applies to all income-generating individuals in Vietnam. Individuals pay PIT on their wages, salaries, and other types of income.

In terms of the collection method, personal income tax is withheld from your employees’ salaries and must be declared and paid to the government monthly or quarterly. The monthly or quarterly tax declaration and payment is only determined once from the first month in which tax deduction arises and applies to the whole tax year, specifically as follows:

| 1. Monthly personal income tax declaration | 2. Quarterly personal income tax declaration | 3. At each time of income generation |

|---|---|---|

| When calculating the withheld tax amount within a month, if at least one type of PIT reaches VND 50 million or more, the individual must pay and declare their PIT monthly. | When calculating the withheld tax amount within a month, if all PIT are under VND 50 million, the individual can pay and declare their PIT quarterly. | Every time revenue is earned through business operations, including transferring real estate, capital, and securities of property rental income (the business must have authorization from income-earning individuals). |

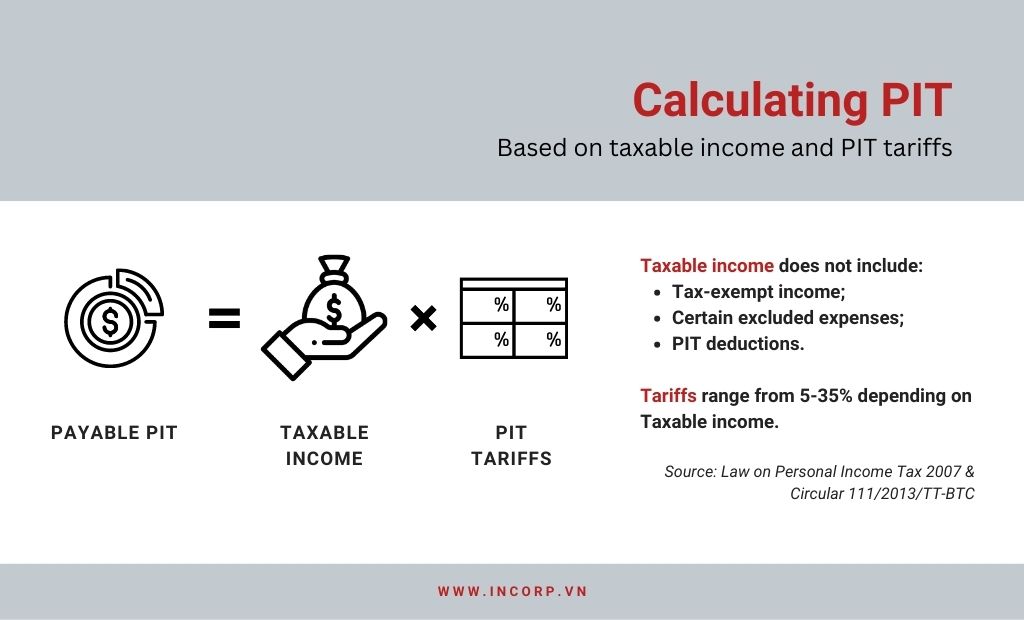

The rate of PIT depends on the kind of income under the contract that individuals sign with enterprises.

Below you will also find the tariffs for PIT, determined based on the individual’s taxable income.

| Level | Yearly taxable income (million VND) | Monthly taxable income (million VND) | Tariff (%) |

|---|---|---|---|

| 1 | Under 60 | Under 5 | 5 |

| 2 | 60 to 120 | 5 to 10 | 10 |

| 3 | 120 to 216 | 10 to 18 | 15 |

| 4 | 216 to 384 | 18 to 32 | 20 |

| 5 | 384 to 624 | 32 to 52 | 25 |

| 6 | 624 to 960 | 52 to 80 | 30 |

| 7 | Above 960 | Above 80 | 35 |

What is the tax registration process in Vietnam?

Every firm in Vietnam must obtain a unique tax registration number, also known as a tax code, in order to comply with their tax responsibilities. The code will also be used as your business license number or enterprise identification (EID) number. All of your company’s financial operations will involve this registration number. To receive the business license number and company tax code, you must submit a company registration application form along with the required paperwork.

Let’s talk about the Business License Tax

The business license tax is an amount of money that enterprises are required to pay manually and annually. The deadline for declaring your business license and submitting the tax is January 30th of the year after obtaining your ERC (Enterprise Registration Certificate).

Here are the rates of business license tax, which are determined by your enterprise’s capital:

| Level | Capital amount | License Tax |

|---|---|---|

| Level 1 | Enterprises with over VND 10 billion in charter capital or investment capital | 3,000,000 VND |

| Level 2 | Enterprises with VND 10 billion or less in charter capital or investment capital | 2,000,000 VND |

If your company’s capital amount (charter capital or investment capital) changes in a way that affects your level of business license tax, you will have to re-submit the business license declaration within the following year. The level of business license tax for the current year will be calculated based on the capital amount of the previous year.

When do I have to pay taxes in Vietnam?

Value-added tax (VAT)

You must file and submit your monthly VAT return by the 20th of the following month.

Quarterly VAT filing and submission are allowed for businesses whose turnover does not exceed VND 50 billion in the previous year. For this case, the declaration and payment needs to be made by the end of the first month in the following quarter.

Corporate income tax (CIT)

In Vietnam, you are required to submit your provisional CIT within 30 days after each quarter.

Additionally, you have to finalize and remit any payable corporate income tax balance within 90 days after each financial year for the annual final CIT returns.

Vietnam’s financial year

Vietnam’s standard financial year is January 1 to December 31. Alternatively, companies in Vietnam, depending on their business activities, are allowed to adopt their own financial year, which can end on either March 31, June 30, or September 30.

In Vietnam, companies are to pay the annual business license fee within the first 30 days of the new calendar year.

We are here to give you guidance and take away your stress, from setting up your Vietnam company to staying compliant and managing your taxes with ease. Say goodbye to legal risks, sanctions and penalties.

About Us

Cekindo is a leading provider of global market entry services in Southeast Asia. We are part of InCorp group, a regional leader in corporate solutions, that encompasses 8 countries in Asia, headquartered in Singapore. With over 900 legal experts serving over 14,000 Corporate Clients across the region, our expertise speaks for itself. We provide transparent legal consulting, setup and advice based on local requirements to make your business perfectly fit into the market with healthy growth.

Don’t take our word for it. Read some reviews from some of our clients.