Value Added Tax, or VAT, is one of the taxes that a consumer pays in Vietnam when they purchase goods and services for production, consumption, and trading. The VAT applies to goods and services purchased from foreign sources as well. However, there are exempted goods or services that attract lower VAT.

Read More about Cekindo’s Comprehensive Accounting Outsourcing Services

The concept of a VAT is that the tax is imposed on the value added to the goods or services at each production stage, from raw materials to manufacturing to distribution to end consumers.

The rate of the VAT depends on the type of goods or services you sell. Therefore, as a business owner, you are also a VAT middleman who collects the VAT from the customers and then pays it forward to the government.

When Should You Register for VAT in Vietnam

Entreprises and organizations that trade and import goods and services into Vietnam are required to register for VAT immediately once they have received their business license. No registration threshold is applicable in this case.

VAT Compliance in Vietnam for 2022

Monthly VAT in Vietnam must be filed and submitted by the 20th of the following month; quarterly VAT in Vietnam is allowed for taxpayers with a turnover of no more than VND 50 billion in the previous or allowed for the new company and it must be declared and paid by the 30th of the following month at the end of each quarter. Monthly VAT or Quarterly VAT must be applied stably for the whole financial year

Please note that all tax invoices must be issued.

A note about E-invoices: Due to Vietnam’s commitment to digitalization, all companies must submit their tax finalizations using E-invoicing. This service is provided by accounting software companies such as MISA

Applicable 2022 VAT Rates

In general, the standard rate of VAT in Vietnam is set at 10%, however, the government passed a Covid relief bill to reduce VAT to 8% for the year 2022. As of January 2023, the standard rate of 10% will be reinstated. A 0%, 5% VAT rate, or VAT-exempted applies to specific industries that are considered high priority to the Vietnamese economy, such as IT and Tech related industries.

RELATED: A Comprehensive Guide to Corporate Tax and Compliance Obligations in Vietnam

How to Calculate VAT

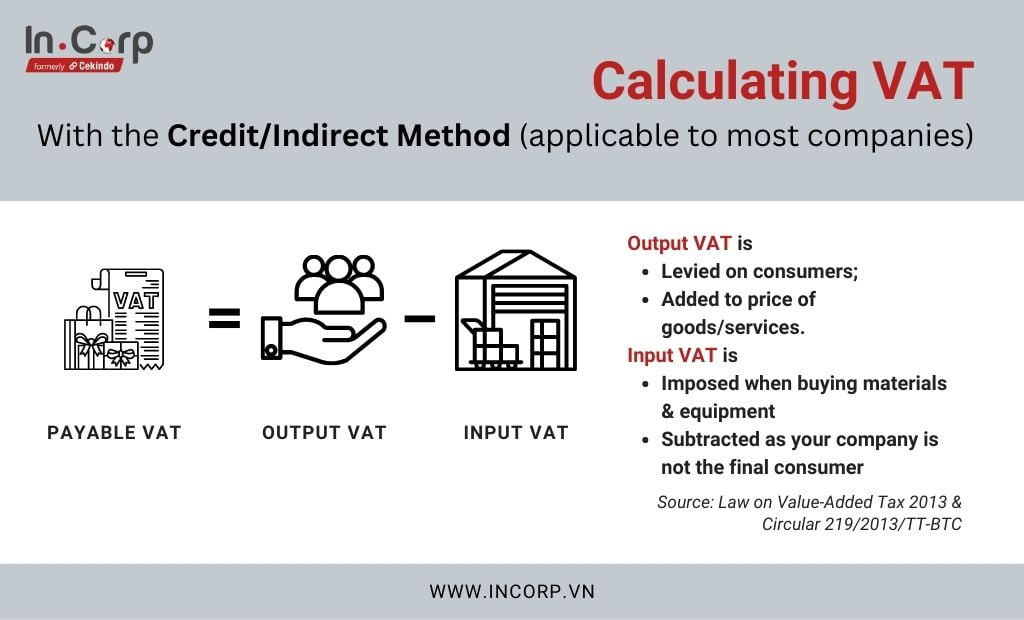

There are two methods to calculate the VAT, the credit method and the direct method:

- Credit method: VAT payable = output VAT – input VAT

- Direct method: VAT payable = turnover x tax rate

VAT Refunds for Companies

In Vietnam, any amount of overpaid VAT will be returned to the company from the government. Refunds of VAT in Vietnam are available only when taxpayers meet certain criteria:

- Exporters in Vietnam with VAT credits of more than VND 300 million for their export transactions

- Companies using the credit method calculation with new projects that are in the pre-operation investment phases. The accumulated VAT credits have to be more than VND 300 million.

The government may also offer VAT refunds as a form of tax incentive for some companies such as oil and gas quarries, restructured enterprises, or certain exporters. For a complete guide to VAT returns, see our latest Q&A article.

About Us

InCorp Vietnam is a leading provider of global market entry services. We are part of InCorp group, a regional leader in corporate solutions, that encompasses 8 countries in Asia-Pacific, headquartered in Singapore. With over 1,100 legal experts serving over 15,000 Corporate Clients across the region, our expertise speaks for itself. We provide transparent legal consulting, setup, and advice based on local requirements to make your business perfectly fit into the market with healthy growth.

Don’t take our word for it. Read some reviews from some of our clients.