Benefits of Outsourcing Your Payroll Services

Our approach to payroll managementin Ho Chi Minh City & Vietnam

As a member of InCorp Group, a leader in corporate services in the Asia Pacific region we have over 10 years of experience in the region assisting foreign businesses set up their operations in Asia. We bring that global experience paired with our local knowledge to bring you world-class payroll services so that you can focus on your bottom line.

Payroll Services in Vietnam – Our Packages

Compulsory Insurance Registration (Health, Social & Unemployment)

When opening a company in Vietnam, initial registration is required to obtain health insurance registration as soon as employees sign the employment contract. We can take care of all statutory social insurance requirements of your entire staff to comply with the current labor laws, which is crucial for your business’ stability.

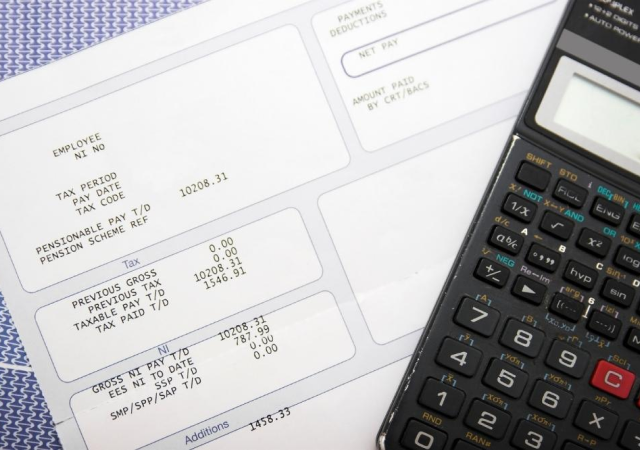

Monthly Payroll Calculation

If you outsource your payroll management with us, our payroll software will ensure on-time monthly calculations based on your cut-off time. Our services are adaptable to all-size companies operating in Vietnam.

Monthly Payslips & Reporting

In addition to monthly payroll calculations, we prepare monthly payslips to be distributed to all your local and foreign employees and monthly reporting. Salary payments, payslips, and reports are all done in a timely and compliant manner.

Personal Income Tax Declaration & Assessment

Regarding personal income tax, you are required to submit a declaration every quarter when your income is less than 50M VND or every month when income is more than 50M VND. We will work with the tax department on your personal income tax declaration and assessment.

Our payroll system is cloud-based and can be easily accessed online. All employee data, including personal data, contracts, and salaries, are stored in one dedicated place with secure access. The online payroll system also provides an easy way to manage employee leaves and attendance.

Payroll Compliance: Income Taxes, Reports & Deadlines

Monthly & Annual Taxable Income for Residents in Vietnam

| Monthly Taxable Income | Yearly Taxable Income | Income Tax |

|---|---|---|

| 0 – 5,000,000VND | 0 – 60,000,000VND | 5% |

| 5,000,000 – 10,000,000VND | 60,000,000 – 120,000,000VND | 10% |

| 10,000,000 – 18,000,000VND | 120,000,000-216,000,000VND | 15% |

| 18,000,000 – 32,000,000VND | 216,000,000 – 384,000VND | 20% |

| 32,000,000 – 52,000,000VND | 384,000,000 – 624,000,000VND | 25% |

| 52,000,000 – 80,000,000VND | 624,000,000 – 960,000,000VND | 30% |

| 80,000,001VND + | 960,000,001VND+ | 35% |

Labor Reports & Deadlines

Statistics Report Due January to June of Every Year

For Foreign Employees

| Item | Deadline to Submit |

|---|---|

| Semi-annual Report on Employment of Foreign Employees | First: January 5th Second: July 5th |

For Local Employees

| Report | Deadline to Submit |

|---|---|

| Semi-annual Report on Labour Accidents | January 10th |

| Annual Report on Occupational Safety & Hygiene | January 10th |

| Annual Report on Unemployment Insurance Contributions | January 15th |

| Semi-annual Report on Change to Employment | June 6th |