Benefits of Outsourcing your Corporate Tax Needs in Vietnam

We take pride in our multinational team of experienced and skilled professionals. Possessing knowledge of Vietnamese business processes and regulations, our accountants ensure tailored solutions to accommodate your business needs. We will always make sure that our tax reporting is based on your requirements and in accordance with the Vietnamese standard operating procedures and applicable laws.

Corporate Tax Advisory & Planning Services Vietnam – What you need to know

In terms of corporate tax reporting and compliance, your company should submit tax statements on a monthly, quarterly, and annual basis, according to your reported income. This reporting is compulsory regardless of whether you conduct any business activities and have any tax liabilities or not. Tax statements should be processed in a timely manner and with great accuracy for on-time submission.

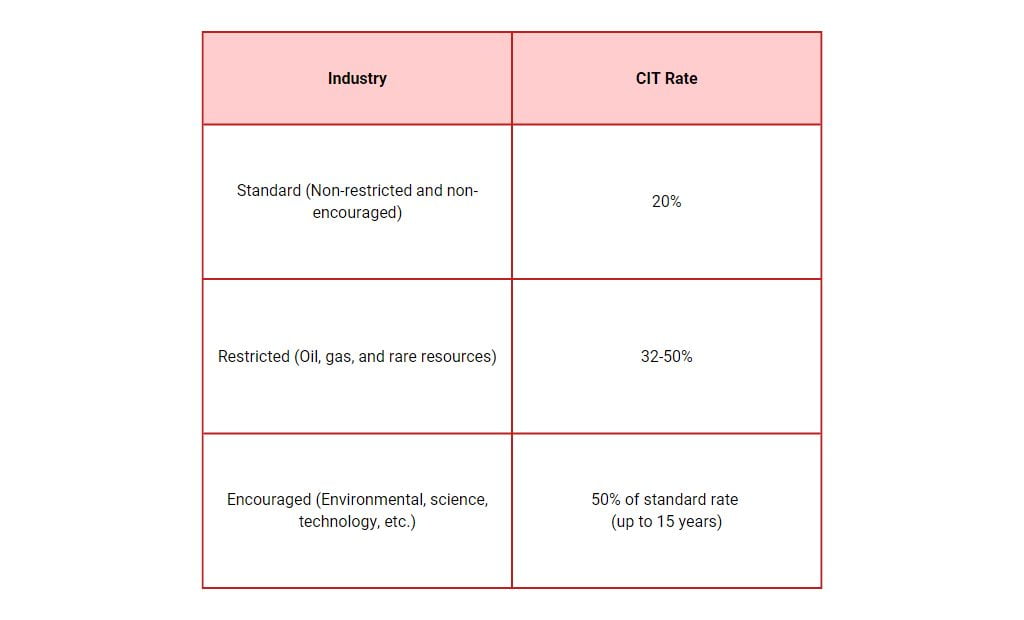

About Corporate Income Tax in Vietnam

Our Corporate Tax & Compliance Services in Vietnam

Monthly, quarterly and annual tax reporting

Focus on your bottom line and let us handle your accounting, e-filing, and tax obligations. We take care of the output value-added tax (VAT) i.e. invoices issued for clients, and input VAT (i.e. invoices issued based on services provided).

We submit a monthly & quarterly report that provides information on the number of invoices issued for clients as well as the number of canceled invoices. Furthermore, we provide calculation services for corporate income tax and personal income tax as well as advisory on deductible expenses.

Preparing Financial Reports

We take care of your monthly, quarterly, and annual tax reporting (including income tax and value-added tax). Our accounting and tax experts also prepare your financial statements by the end of the year. Furthermore, we classify and check the validity of all reports and whether they are in compliance with the local Vietnamese tax regulations prior to submitting the final financial statements.

Other tax compliance such as Withholding Tax, internal tax accounting & More

In addition, we also take care of other tax compliance needs in Vietnam, such as withholding taxes and internal tax accounting, if required by your company. Withholding tax rates may be different between one company and another, depending on your contract & business setup.