The personal income tax system in Vietnam can be challenging sometimes. Like most jurisdictions around the world, the Vietnamese tax system imposes special regulations on expatriates living and working in the country. As Vietnam’s economy has witnessed exponential growth over the last decade, the

The personal tax system for foreigners living in Vietnam involves special tax rates, calculations, and procedures. These calculations and procedures can be much more difficult for you to comprehend if you do not have specialized knowledge. This is a guide with everything you need to know regarding how much you are required to pay, monthly and yearly.

Read More About Cekindo’s Corporate Tax & Compliance Services for Foreign Firms

The personal income tax rules often apply to the time a foreigner spends in Vietnam, whether they are tax residents or non-tax residents. This article highlights the key regulatory elements with regard to personal income taxes so that you, as an ex-pat, can understand your tax liabilities.

Definition of Personal Income Tax

The personal income tax is what an individual needs to pay to the Vietnamese department of taxation based on the amount of income earned.

Sources of income that are subject to personal income tax in Vietnam include salary and wages, capital investments, capital transfer, franchising income, inheritance, etc.

Who Are Considered Tax Residents in Vietnam?

The level of income decides how much in taxes an ex-pat has to pay. Also, for ex-pats who are deemed as tax residents in Vietnam, they must meet one of the following conditions:

- Expats stay in Vietnam for no fewer than 183 days within a 12-month period, starting from the first arrival in Vietnam

- Expats with permanent residency in Vietnam that is recorded on a Temporary Residence Card or a Permanent Residence Card

- Expats who have signed rental contracts of over 183 days

If an ex-pat does not meet any of the mentioned conditions, he or she will be regarded as a non-tax resident in Vietnam.

Related article: 5 Challenges of Accounting and Tax Compliance in Vietnam

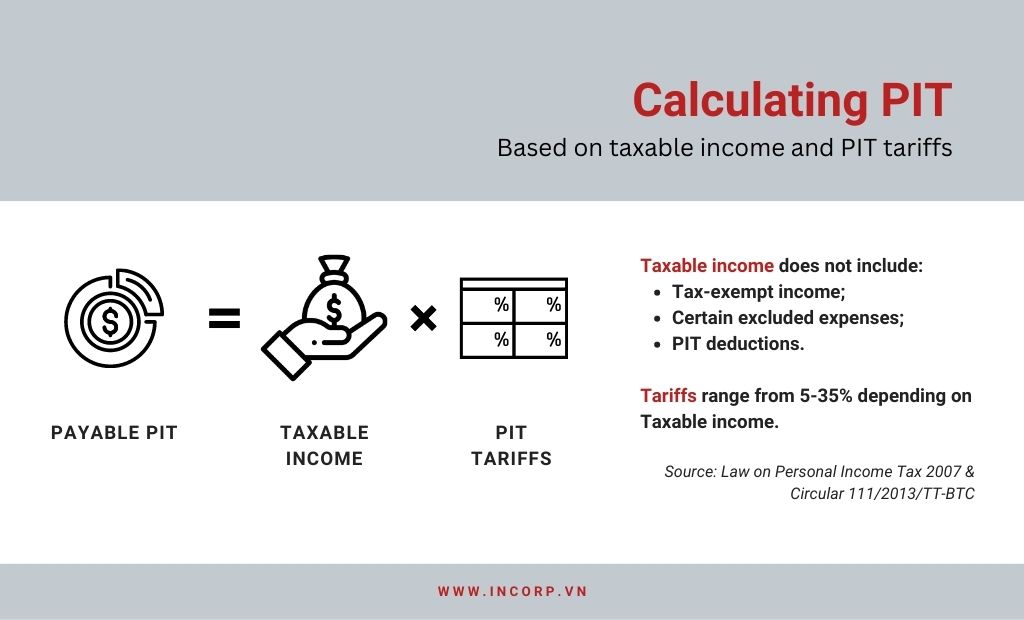

How to Calculate Expat’s Personal Income Tax in Vietnam

The monthly salary of an ex-pat is also the monthly taxable income in Vietnam. For tax residents, their monthly taxable income is taxed at a progressive rate of 5-35%; for non-tax residents, it is a fixed 20%.

Calculate Your Taxable Income Rate:

Monthly Personal Income Tax Calculation

| Monthly Taxable Income | Tax | Calculation |

|---|---|---|

| From 0 to <= 5,000,000VND | 5% | 5% x Assessable income |

| From >5,000,000 to <= 10,000,000VND | 10% | 10% x Assessable income – 250.000VND |

| From >10,000,000 to <= 18,000,000VND | 15% | 15% x Assessable income – 750.000VND |

| From >18,000,000 to <= 32,000,000VND | 20% | 20% x Assessable income – 1.650.000VND |

| From >32,000,000 to <= 52,000,000VND | 25% | 25% x Assessable income – 3.250.000VND |

| From >54,000,000 to <= 80,000,000VND | 30% | 30% x Assessable income – 5.850.000VND |

| From >80,000,000VND | 35% | 35% x Assessable income – 9.850.000 |

Tax Rates of Other Personal Incomes for Tax Residents

For other income, the tax rate is between 0.5% and 10%:

- Non-bank interest: 5%

- Dividends: 5%

- Business income: 0.5-5%

- Capital transfer: 20% of the profit

- Public share sales: 0.1% of the profit

- Real estate sales: 2% of the profit

- Prizes, gifts, and inheritance income: 10%

- Franchise, copyright and royalties income: 5%

Personal Income Tax Deduction

Based on Resolution 954/2020/UBTVQH14 on June 2, 2020 about the Increases in family circumstance-based deduction for Personal Income Tax, take note of the following:

- Increase Individual Deduction from VND 9 million per month to VND 11 million per month.

- Increase Family Deduction from VND 3,6 million per month to VND 4,4 million per month.

- These increases will reduce the accessible income for PIT treatment.

- These changes are applied for monthly PIT treatment valid from July 1, 2020 and PIT finalization for 2020.

You might want to read: How Do You Calculate Your Foreign Contractor Tax in Vietnam?

Non-Taxable Income and Benefits for Expats

Below are some benefits and income that are not included in the taxable personal income for expats:

- Expats’ round-trip airfares (once per year)

- School fees of expats’ children (tertiary school fees are excluded)

- Costs of relocation to Vietnam for the purpose of employment (one-off)

- Funeral or wedding allowances and benefits

- Membership benefits

- Payments from insurance

- Interests earned from bank deposits

- Income from casino’s winning

- Inheritance from direct family members

- A property transfer between direct family members

- and so forth

Related article: Living in Vietnam: 10 Laws Expats Must Know

Deadline for Tax Finalisation

Last but not least, it is important to be aware of what is called tax finalization. The annual tax finalization for tax residents should be done within 90 days of the following tax year, which usually falls on March 31st.

About Us

InCorp Vietnam is a leading provider of global market entry services. We are part of InCorp group, a regional leader in corporate solutions, that encompasses 8 countries in Asia-Pacific, headquartered in Singapore. With over 1,100 legal experts serving over 15,000 Corporate Clients across the region, our expertise speaks for itself. We provide transparent legal consulting, setup, and advice based on local requirements to make your business perfectly fit into the market with healthy growth.

Don’t take our word for it. Read some reviews from some of our clients.