Overview

Experts say that Vietnam is on track to become Southeast Asia’s investment hotspot. Its central location in Southeast Asia, rapid industrialization and urbanization, stable development rate, continuous innovation, socio-economic objectives, and increased economic integration are all major catalysts. With ambitious goals to attract half of Fortune 500 by 2030, Vietnam might become one of the most lucrative markets in Asia-Pacific for international investors.

Investing in Vietnam? Let us make your market entry process effortless and hassle-free.

With generous policies for investment and a myriad of business opportunities for both small-and-medium enterprises (SMEs) and corporations, Vietnam attracts a multitude of multinationals from German power giant BayWa to the iconic Danish Lego, as well as global conglomerates like America’s Microsoft.

According to Harvard’s Growth Lab, the next decade will see Vietnam become one of the world’s five fastest growing countries, alongside China and India.

Let us take a look at some of the best sectors for investment in Vietnam in 2022 and 2023.

Vietnam’s most lucrative sectors

High-end and Luxury Hotels

Before the pandemic, Vietnam’s tourism revenue reached USD 10.8 billion. Reports estimate that 2024’s revenue would surpass this number, reaching over USD 13 billion in 2026. Though accommodation businesses in tourism and hospitality industry are flourishing in Vietnam, the high-end and luxury hotel sector, particularly 4 or 5-star hotels, are still untapped in the country. Therefore, these upscale tourism accommodations present a huge investment potential.

Preferred ways to get started in this untapped sector is via joint ventures and partnerships in major cities such as Hanoi and Ho Chi Minh City, where the highest number of tourists are recorded.

In Vietnam, the luxury hotels are mainly dominated by well-established international brands such as Accorhotels, InterContinental Group and Hilton Group. Thus, joint ventures and partnerships with local developers are the best options for foreign investors to get into the scene.

Logistics & manufacturing

Despite various ongoing supply chain concerns, such as China’s zero COVID measures, Vietnam’s manufacturing and logistics sector still shows attractive prospects. Vietnam, in particular, is likely to benefit from its favorable strategic location, diverse demographics, and steady growth in low- and mid-skilled talent. These intrinsic factors are further enhanced by the country’s many free trade agreements (FTAs) and rapidly changing e-commerce landscape.

RELATED: A Summary of All of Vietnam’s 14 Free Trade Agreements

Such qualities make Vietnam an intriguing alternative for international investors. This invariably means that the supply chain will need to expand to new areas to saturate the expanding market, namely cold chain (e.g. for vaccine transportation) or optimized coordination between industrial and logistical hubs.

Furthermore, as more advanced technology (like robotics, IoT, and cloud-based software) becomes accessible, manufacturers will likely fully immerse themselves in the fourth industrial revolution. It can dramatically improve traditional production lines with waste reduction and automation, creating a much more robust supply chain.

Solar and Wind Energy

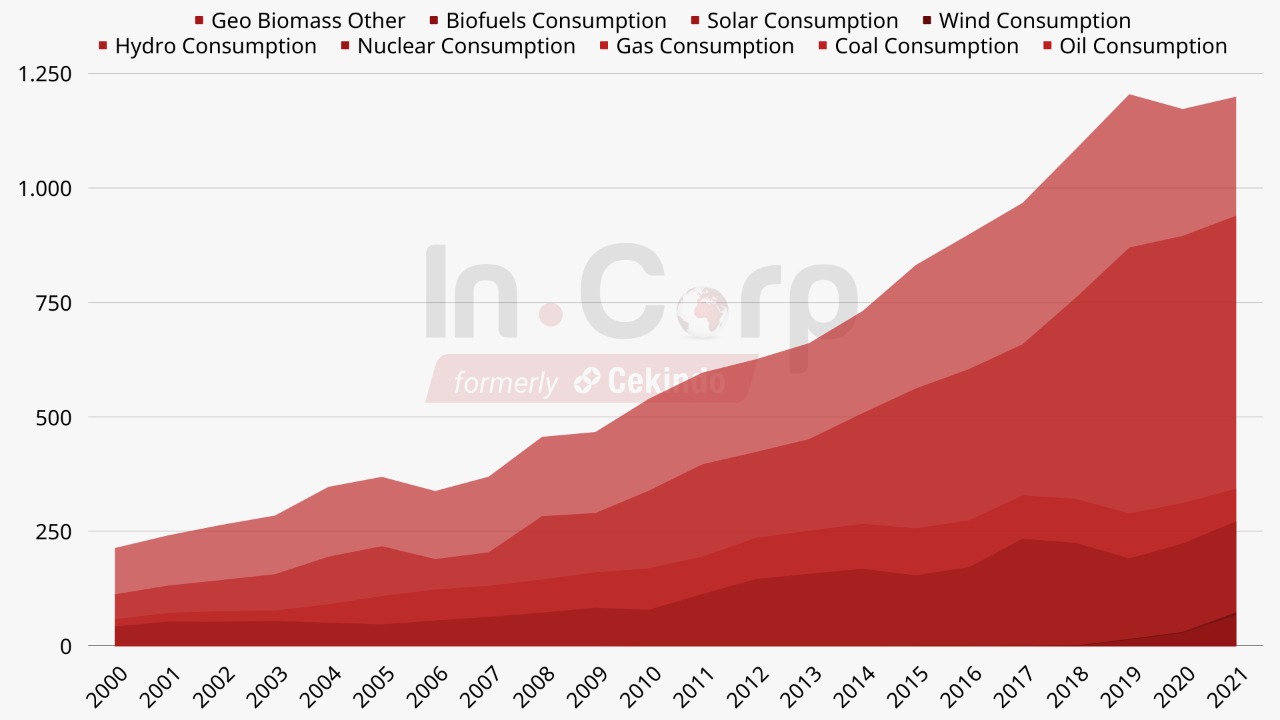

Here’s an illustration of Vietnam’s energy sources and their proportion in the power grid.

Most of Vietnam’s power plants are still based on fossil fuels, namely coal (49.7%) and oil (21.7%).

The country is also pushing its renewable energy initiatives with hydropower (16.5%).

Coal, hydroelectric, and gas turbines are the primary sources of energy generation in Vietnam. However, the Vietnamese government is working to move away from these non-renewable resources and promote the usage of renewable energy. Plans are in place to utilize the country’s solar and wind energy resources to increase the share of renewable power generation three-fold by 2030.

Location-wise, the southern region in Vietnam is more suitable for investors to put their money in solar projects, while the mountainous regions of central Vietnam and the coastal areas in the south-central region are suitable for wind energy projects. https://ourworldindata.org/energy/country/vietnam

Retail Banking and Fintech

Despite the growth in Vietnam’s middle and working class, a large portion of the population (approximately 30% of adults) remains unbanked. Combined with the underdeveloped banking and financial services sector, investors can find numerous opportunities in the constantly evolving landscape.

Among the many banking and financial sectors, retail banking with payment cards and wealth management services are particularly high potential. Fintech is also another sector to look into as Vietnam has a good foundation to transform into a cashless society in the very near future, due to its high mobile penetration.

E-commerce

Looking at recent insights on Vietnam’s online shopping community, it’s hard to deny the country’s spending power and the role of e-commerce in people’s lives. Forecasts by Ninja Van Group suggest that online shoppers in Vietnam will grow to 51 million (over half of the total population) by the end of 2022.

The pandemic has certainly had an impact on shopping trends around the world, and the e-commerce boom has been a direct result of that. However, there are several challenges hindering what could be a very bright future for the sector.

Experts name increasing competition (both between online platforms and against physical locations) and lack of market research (due to slow technology adoption) as challenges for e-commerce companies.

Ready to start investing in Vietnam? You can start with our Vietnam Business Setup Checklist, tailored to the needs of international investors just like you.

This article was originally published in June 2019, and was updated with latest trends and insights in October 2022.

Originally published: 4 June 2019, latest update: 10 October 2022

About us

Cekindo is a leading provider of global market entry services in Southeast Asia. We are part of InCorp group, a regional leader in corporate solutions, that encompasses 8 countries in Asia, headquartered in Singapore. With over 500 legal experts serving over 12,000 Corporate Clients across the region, our expertise speaks for itself. We provide transparent legal consulting, setup, and advice based on local requirements to make your business perfectly fit into the market with healthy growth. Don’t take our word for it. Read some reviews from some of our clients.