As an emerging market on the cusp of transitioning from a lower-income nation to a middle-income nation Vietnam presents fantastic opportunities for new investors, including in its stock market. However, investing in the Vietnam Stock Market without prior knowledge of the procedural nuances can leave an investor vulnerable to pitfalls. This article cites specifics one might need to know in order to set up a stock market account and start making smart investments.

Read More

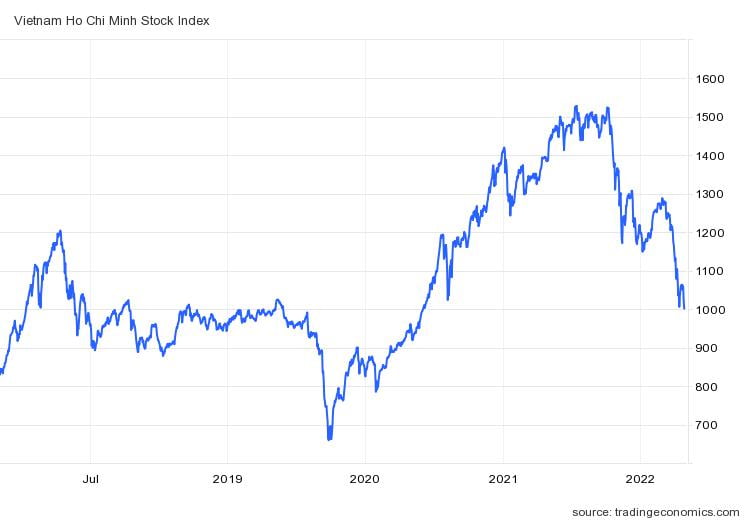

See below the price of the Vietnamese Stock Exchange, compared over the last 5 years.

Steps to Open a Stock Market Account in Vietnam for Foreigner Investors

1. Prepare the necessary paperwork

For Individual investors:

- A valid passport

- At least four notarized copies of your passport.

For Investment Firms or Institutional Investors:

- 1 registration form for securities trading code, from the Vietnam Securities Depository

- 1 legalized copy of the incorporation certificate in the host nation, together with a notarized translation of the document into Vietnamese

- 1 copy of the Passport of the authorized representative

2. Open a Vietnamese bank account:

For Individual investors:

- Opening the account from abroad

If you live outside of Vietnam and would like to open a trading account, get in touch with of our consultants to open a bank account in your name.

- Opening the account in Vietnam

Individual investors must first create a bank account at a custodial bank which also allows them to link their bank account to a stock trading account.

Related: How to Set Up a Business in Vietnam

Institutional investors:

Institutional investors are required to open a custodial bank account. The requirements are listed below:

- Certificate of Incorporation

- ID/Passport of the authorized person

- Other forms as required by the Custodian Bank

3. Obtain Your Unique Securities Trading Code – Institutional Investors

To trade stock or any type of securities, in Vietnam, all institutional investors are required to have a Securities Trading Code. The application of such code is mentioned previously

4. Open a stock trading account

After completing the required documents, the investor needs to take them to the brokerage firm to complete the account opening process. It is also advised that the investor contact a brokerage company first to ensure that they have someone who can advise and assist them in their language through the entire process.

Setting up a stock account in Vietnam could be easier with a brokerage company helping out at every turn of the way. However, it is necessary for an investor to understand and make note of some specifics listed in the following section to avoid any procedural pitfall.

Specifics to Keep In Mind Before Opening a Stock Market Account

When you open a stock account in Vietnam, you will often be required to sign three contracts with the brokerage securities company. These contracts include a contract for creating a stock account, a margin contract, and an internet banking transfer. Before you sign, you should have a thorough understanding of the contract’s contents.

Before signing the contract, the investor should be aware of the following points:

Know all the fees that you have to pay

- Trading fee: The trading fee is the major fee that you should be aware of. If you trade frequently, this cost will make up the majority of your total. The trading charge is usually computed as a percentage of the total trading value for the day.

- Custodial fee: Safekeeping services are charged by a brokerage or other financial institution. This charge is negligible in the Vietnam stock market, at 0.4 VND/month/share.

- Income tax from selling Securities – 0.1% of the Sales Value.

- Cash Dividend Tax – 5% of the Cash Dividend Value actually received.

Avoid margin lending contract

Foreign investors are not allowed to employ margin on Vietnam’s stock market as per Circular No. 203 by the Ministry of Finance. However, certain groups continue to provide international investors with margin services. To prevent financial and legal dangers, we advise investors not to use these services.

Internet banking and transferring money

According to Vietnam’s securities regulations, there should have been many local banks and foreign banks that are allowed to custody stocks for foreigners. But due to the small potential revenue and Vietnam’s strict currency management regulations of foreigners, most large brokerage companies (HSC, SSI, and VCSC) only collaborate with BIDV (Bank for Investment and Development of Vietnam) while opening a stock account for foreign investors.

Related: Transferring Money Outside of Vietnam as a Foreigner

BIDV does not allow foreigners to transfer money online due to tight indirect investment management restrictions. In most cases, foreigners must appear in person at a BIDV office to complete their transferring documentation and complete the transfer procedures. However, in some situations, investors may have a representative in Vietnam who can offer to provide the transferring money paperwork to the investor via BIDV, allowing the investor to complete the transfer order from outside of Vietnam. In that situation, the procedures could take up to a week to complete.

An alternative security trading platform is KSB, and they work with a range of international banks including such big names as HSBC, Citibank, Standard Chartered Bank & Shinhan Bank. We recommend this route for foreign traders, as these banks will have English-speaking staff and will have more experience helping foreign traders.

About Us

InCorp Vietnam is a leading provider of global market entry services. We are part of InCorp group, a regional leader in corporate solutions, that encompasses 8 countries in Asia-Pacific, headquartered in Singapore. With over 1,100 legal experts serving over 15,000 Corporate Clients across the region, our expertise speaks for itself. We provide transparent legal consulting, setup, and advice based on local requirements to make your business perfectly fit into the market with healthy growth.

Don’t take our word for it. Read some reviews from some of our clients.