- The Current State of Green Energy Investment Opportunities

- World Bank-backed Green Energy Initiatives in Vietnam

- Incentives by the Vietnamese government

- Green Energy Foreign Direct Investments (FDI)

- Green and renewable projects make up for the majority of the FDI inflows.

- 2030 and beyond – Government plans for Vietnam’s Green energy

- Challenges toward a green energy future

Vietnam has been playing a proactive role in developing a sustainable future and diversifying its power mix by placing significant reliance on green energy projects. With some lofty long-term goals including carbon neutrality by 2050, which entails scaling back energy needs from coal plants and increasing its alternative energy sources, Vietnam is in need of foreign investment to meet its deadlines.

Investing in Vietnam? See Our Business Set Up Services

The Current State of Green Energy Investment Opportunities

Vietnam has a solar and wind energy capacity of 16.6 Gigawatts and 0.6 Gigawatts, respectively, as of 2020. By 2030, it is anticipated that the nation’s solar and wind energy capacities will be 18.6 Gigawatts and 18.0 Gigawatts, respectively, according to the draft Power Development Planning (PDP) 8. However, the nation must update both its transmission and distribution infrastructure in order to manage the capacity increase and guarantee that power is distributed where it is needed. Regarding this, the government recently passed a new law that gives the modernization of aging networks first priority.

The draft Power Development Planning 8 also has a section on grid development, which entails increasing the number of high-voltage transmission lines and developing the grid infrastructure in order to reduce grid overload and, in the process, incorporate renewable energy.

In the parts of the country where the new solar energy stations have been built the electricity infrastructure, including the transmission and distribution centers are suffering from an overload of electricity as they were not upgraded in time for the new surge in power.

Without long-term planning and a proper upgrade to the current system, it will be hard to integrate the new power sources into the grid. That being said, the central and southern localities are working hard to build new lines and connect more cities according to a recent report by the US Energy Information Agency.

World Bank-backed Green Energy Initiatives in Vietnam

To support the development of a commercial financing market for energy-efficient industrial investments, the World Bank and the Green Climate Fund have signed a USD 11.3 million grant with the State Bank of Vietnam. The said financial assistance also includes a USD 75 million guarantee.

With USD 8.3 million out of the total grant of USD 11.3 million grant allocated for the private sector to be able to identify, evaluate, and implement energy-efficient projects. As a direct consequence private companies will also be able to provide the Ministry of Industry and Trade, government organizations, and other pertinent authorities with technical assistance in order to strengthen the current policy and regulatory framework and advance the development of an energy-efficient market in Vietnam.

RELATED: Solar Energy Investment Opportunities in Vietnam

Funds remaining from the grant and the guarantee will be used to create a risk-sharing facility which will further be used to support local banks that may be at risk of possible defaults on loans extended to energy-efficient projects. This facility is projected to lower lender risks by raising around USD 250 million for commercial financing, which would make it easier to offer loans to industrial organizations and energy service providers with competitive terms and minimal collateral requirements.

According to the World Bank’s Low Carbon Study, if extensive demand-side energy-efficient investments are made, Vietnam might save up to 11 gigawatts of energy. According to the World Bank, Vietnam’s major sectors require investments in energy efficiency of about US$3.6 billion.

Incentives by the Vietnamese government

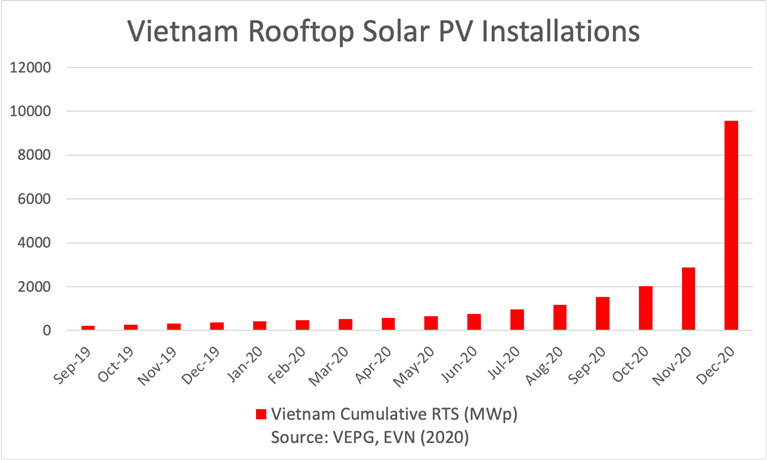

In its bid to improve the adoption of green energy, the Vietnamese government offered a generous USD 0.09 for each kilowatt-hour produced by solar farms which was significantly higher than what is paid to other energy producers. Accordion to a report by the Economist, by the end of 2019, the country generated 5 gigawatts, which is more than what Australia generates.

Green Energy Foreign Direct Investments (FDI)

Vietnam’s proactive approach to dealing with its energy needs is paired with its strong ties with clean-energy leaders in Europe. This has allowed Vietnam to speed up its renewable energy transition and has further opened up opportunities for foreign investors to explore their options in the country.

Foreign investors are also pleased with Fitch’s recent BB rating and the positive outlook that has been given to state-owned Vietnam Electricity Group (EVN). In addition, the rating agency has commented that it expects the company’s growth and financial profile to get even more robust over time.

Green and renewable projects make up for the majority of the FDI inflows.

Thanks to its long-term carbon neutrality goals paired with its investment-friendly policies Vietnam has attracted impressive amounts of foreign investment in recent years.

An MoU was signed between the LEGO Group and Vietnam-Singapore Industrial Park Joint Venture, underlying plans to set up its very first carbon-neutral factory. This is a USD 1 billion project that will generate 4,000 employment opportunities over the next 15 years.

Furthermore, Ho Chi Minh City Development Joint Stock Commercial Bank (HDBank) received a US$ 50 million loan from the French development finance organization Proparco to finance green projects to promote sustainable development.

To further encourage the private sector in Vietnam, the International Financial Corporation (IFC) recently extended a US$ 100 million long-term loan to the Orient Commercial Joint Stock Bank (OCB). As reported on local news this loan was specifically geared towards promoting climate-friendly projects in Vietnam by lending to small- and medium-sized enterprises (SMEs).

2030 and beyond – Government plans for Vietnam’s Green energy

- Reduce greenhouse gas emissions by 25% in 2030 and around 45% in 2050.

- Total electricity generated from wind sources shall increase to 2,000 MW in 2025, and 6,000 MW in 2030. The share of wind power in total electricity production shall account for 1% of total energy generation in 2030.

- The share of biomass energy in total electricity production shall account for 1% in 2020, 1.2 % in 2025, 2.1% in 2030.

- By 2025 and 2030, the entire amount of solar energy produced will rise to 4,000 MW and 12,000 MW, respectively. By 2030, solar energy will contribute for 3.3% of all electricity produced, up from 1.6% in 2025.

*Source: Asia Pacific Energy

Challenges toward a green energy future

Vietnam has been able to identify, so far, that it is imperative to shift away from the traditional growth models in order to sustain the development gains that have been achieved in the past decades. Accordingly, it has developed a National Green Growth Strategy (VGGS) and a Green Growth Action Plan. However, the implementation of the VGGS is likely to cost at least $30 billion, which means that there needs to be an increase in the current funding levels.

For Vietnam to be able to achieve a low-carbon economy by 2030 & complete carbon neutrality by 2050 there is expected to be an incremental cost of 1% of its GDP. However, the country’s current expenditure towards this goal is only about 0.1% of its GDP. This is likely to prevent the country from enabling green growth, at the levels, it has promised. To avoid that, according to The Global Green Growth Institute Vietnam will have to increase the effectiveness of each dollar put towards climate financing. In addition, it will also have to diversify its funding sources, in the process.

RELATED: Vietnam to Start Carbon Pricing in 2025

Infrastructure Challenges

As already mentioned, the biggest challenges lie in Vietnam’s antiquated grid, throughout the entire country. With the actualization of the 1% GDP investment amount in this area, Vietnam can expect to meet the deadlines it has set itself.

About Us

Cekindo Vietnam is part of InCorp Group, based in Singapore. Incorp is the largest Asia-based corporate service provider in the APAC Region. We assist foreign companies with their market entry needs in Vietnam, including Company Registration, Accounting & Taxes, HR & Payroll, Product Registration, Employment of Record, and other services.