Benefits of Establishing a Limited Liability Company in Vietnam

LLC Entity Set Up in Vietnam – What You Need to Know

A Limited Liability Company (LLC) is the most common legal entity type in Vietnam. It is the ideal business identity for small and medium-sized enterprises (SMEs), considering its simple corporate structure that requires only one founder.

Furthermore, LLC is an excellent choice for entrepreneurs who intend to protect their personal assets, as the liability of the shareholders is limited to their shares only. Foreign investors can start an LLC as a whole company or as an individual. However, the process and required documents are different.

Requirements for Registering a Limited Liability Company in Vietnam

LLC REQUIREMENTS AS A COMPANY

For investors who intend to register a Limited Liability Company as a company, the following requirements must be satisfied:

- A registered business address : this can be a physical or a virtual address. It also depends on the business license requirements.

- Business Certificate : (Certificate of Establishment) or an equivalent paper that can certify the legal status.

- Charter Capital the amount must be high enough to cover the company’s expenses, such as office lease, salaries, operational expenses, etc, for at least the next six months. Generally, for a simple FDI LLC, the recommended amount is a minimum of 20,000 USD.

- Financial documents : for example, the bank statement with the same or bigger amount of charter capital intended to invest in Vietnam. The investor(s) must submit any legalized copies of their financial documents.

- Legal Representative : in a management role or higher, living in Vietnam full time, regardless of nationality.

- Official Identity : notarised copies of the Investor and Legal Representative(s)’s official ID (i.e. passport)

LLC REQUIREMENTS AS AN INDIVIDUAL

For investors who intend to register a Limited Liability Company as an individual, the following requirements must be met:

- A registered business address : this can be a physical or a virtual address. It also depends on the business license requirements.

- Legal Representative : in a management role or higher, living in Vietnam full time, regardless of nationality.

- Charter Capital the amount must be high enough to cover the company’s expenses, such as office lease, salaries, operational expenses, etc, for at least the next six months. Generally, for a simple FDI LLC, the recommended amount is a minimum of 20,000 USD.

- Legalized Bank Statement : you will need to provide a legalized copy of your bank statement with the balance showing it is larger than the Charter Capital amount. The bank statement will need to be legalized at the Vietnamese Embassy in the country of your bank statement and then translated and notarised in Vietnam.

- Notarised or legalized copies of the Official Identity : notarised copies of the Investor and Legal Representative(s)’s official ID (i.e. passport)

Procedures for Limited Liability Company Establishment in Vietnam

Apply for Investment Registration

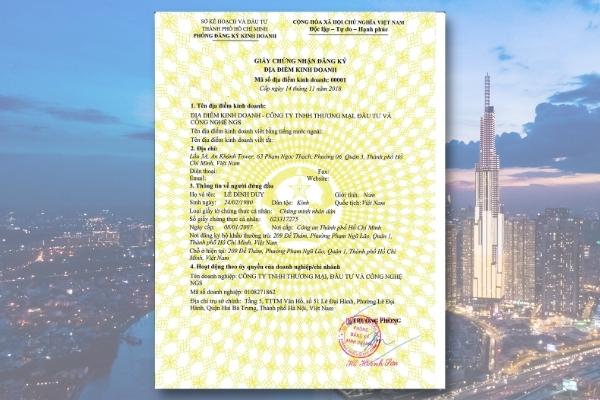

Issued by the Department of Planning and Investment, IRC is one of the essential legal documents to start with. This certificate shows details on the registered investment project that the foreign investors are directly involved in through direct investment.

Also issued by the Department of Planning and Investment, an ERC is a hard copy that contains information on enterprise registration. For LLC, a Tax Code, aka a Business Code will be issued on ERC as well. These applications must be in Vietnamese.

Create a Company Seal

As it is the custom in business in Vietnam, a seal is very important since it proves that a paper or document issued by the company is legally valid. If a paper or document that displays official acts does not get stamped, it is not possible to signify that the acts are truly the deeds of the company.

Previously, each organization needed to register the business seal template with the appropriate authority before utilizing it; however, this is no longer the case under the present law. The type, number, design, and content of the company’s seal will be determined by the company. The company’s charter or regulations must be followed in the management and storage of seals. Companies must employ seals in transactions as required by law.

.png)

Documents and payments submission for post-license requirements

Open a bank account, pay for business taxes, contribute to charter capital, order e-invoice, provide e-signature and company stamps, etc.

Other licenses/certificates application (if any)

Make applications for any other necessary sub-licenses/certificates. This depends on the sector that a company is in. For example, if a company does wine trading, a wine retail license or wine wholesale license is required.

Things to know before Incorporating a company in Vietnam

Do I have to be in Vietnam to set up my company?

The answer is no. We can arrange for your company to be set up fully remotely, in your name, and ready to operate as long as all the required documents are submitted.

What documents are needed to start the process?

What certificates will be issued in order to start operations?

Nominee Director (AKA Legal Representative) Requirements in Vietnam

For your company to be operating in Vietnam it needs Legal Representatives, also known as Directors. These people can be you or anyone on your team, however, it is required at least 1 Legal Representative resident in Vietnam. If you are setting up a company remotely, you will need to nominate a legal representative who is living in Vietnam legally. This is a service that Cekindo Vietnam can guide you through.

Things to know about the Nominee Director: